Top Tips 2024: Pullbacks, Corrections, and Bear Markets: A Guide to Market Volatility

Provided by James Financial Partners

When the market drops, some investors lose the perspective that downtrends and uptrends are part of the investing cycle. When stock prices break lower, it's a good time to review common terms that are used to describe the market's downward momentum.

Pullbacks.

A pullback represents the mildest form of a selloff in the markets. You might hear an investor or trader refer to a dip of 5-10% after a peak as a “pullback.”1

Corrections.

The next degree in severity is a “correction.” If a market or markets retreat 10% to 20% after a peak, you’re in correction territory. At this point, you’re likely on guard for the next tier.2

Bear Market.

In a bear market, the decline is 20% or more since the last peak.2

All of this is normal.

“Pullbacks, corrections, and bear markets are a part of the investing cycle."

When stock prices are trending lower, some investors can second-guess their risk tolerance. But periods of market volatility can be the worst times to consider portfolio decisions.

Pullbacks and corrections are relatively common and represent something that any investor may see from time to time in their financial life, often several times over the course of a decade. Bear markets are much more rare.

Bullish years, like 2024, often have corrections. Let’s visit a few historical facts regarding equity markets to dive into this further.

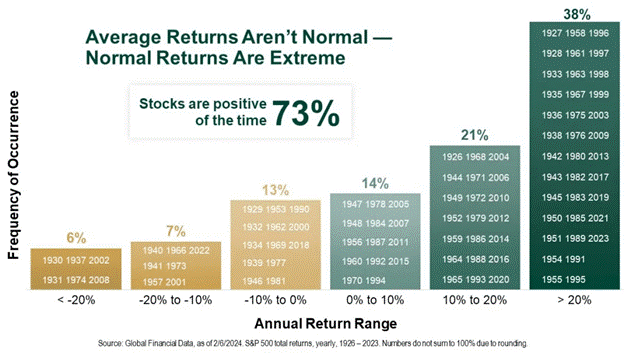

- Historically speaking, the stock market increases about 73% of the time and decreases about 27% of the time.

- Looking at the chart below, you can see that history has shown that drawdowns of 10% or greater have only happened 13% of the time since 1926.

- The chart also shows that 38% of the time, the market has returned 20% or greater versus just 6% of the time where the market was down by 20% or greater.

- A correction of 20% or more has rarely happened in the middle of a bullish year.

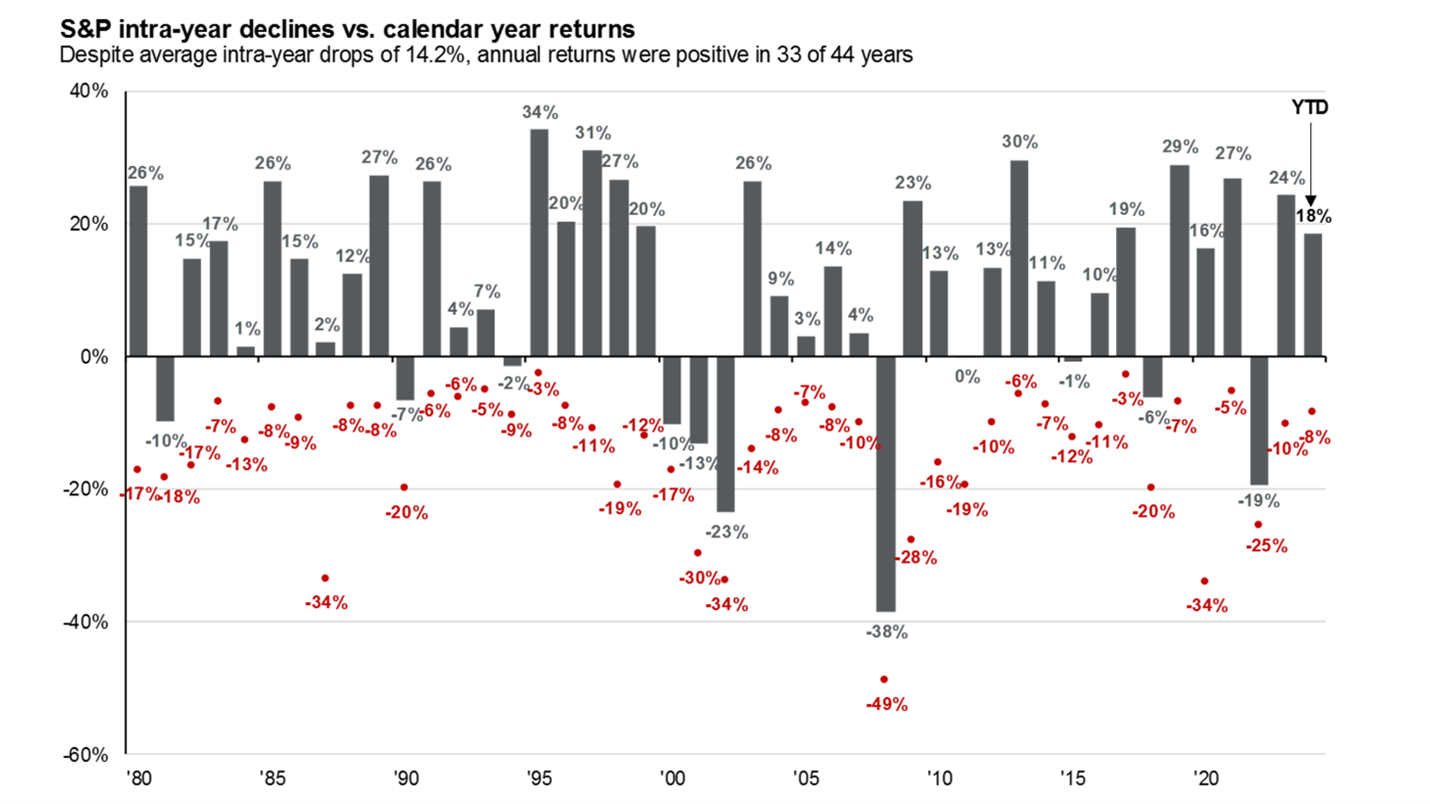

See below for a well-known chart that is put out regularly by JPMorgan Asset Management. JPMorgan’s description of this chart is as follows:

“Annual returns and intra-year declines: This chart shows intra-year stock market declines (red dot and number), as well as the market's return for the full year (gray bar). This chart makes it clear that the market is capable of recovering from intra-year drops and finishing the year in positive territory, which should encourage investors to stay the course when markets get choppy.” (Data as of August 31, 2024)

A retirement strategy formed with a financial professional has market volatility factored in. As you continue your relationship with that professional, they will also be at your side to make any adjustments and help you make any necessary decisions along the way. Their goal is to help you pursue your goals.

In summary, as we look at the current market conditions, we must evaluate the probabilities rather than the possibilities. There are a lot of current market fundamentals that are strong and encouraging of what the future could hold. While there have been some slightly disappointing data points this year in regards to the labor market and consumer spending, the underlying fundamentals of the market remain encouraging.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with Osaic Wealth Inc. or James Financial Partners. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Copyright 2024 FMG Suite.

- TheBalanceMoney.com, 2024

2. Investopedia.com, March 24, 2024