Series: Making room for economic growth

Economic development is an ongoing, competitive process. We are always competing with other regions across the country and around the globe both to attract businesses as well as keep the employers we already have. To stay in the running, we have to ask ourselves, “do we have the best business climate, the best workforce, the best transportation connections?”

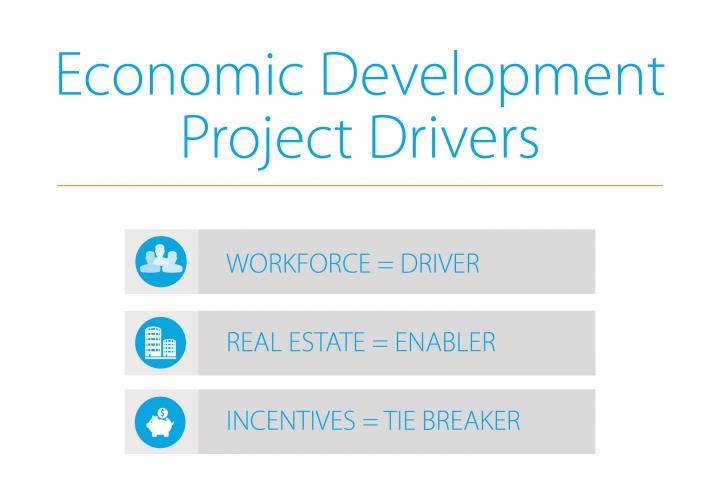

I’ve discussed how a top quality workforce is quickly becoming the lead factor in site selection decisions, but there are several other areas where regions like ours must be able to compete in order to have a shot at winning. One of the areas where the Springfield region continually comes up short is in “turn-key” real estate options. If there is such a thing as a good problem, this is one of them--but a problem nonetheless.

Read our last post: Talent wars and our strategies to win

If you’ve visited with anyone doing economic development at our Chamber or within our region, you’ve probably heard us talk about speculative industrial buildings. The demand for these buildings is grounded in one thing—speed to market. Healthy companies today have weathered the recession and strengthened their cash position, but they refuse to expand too quickly. Instead, they stretch their resources and facilities as far as they can until they are forced to expand. By that point, they need a solution that was ready to go yesterday. When time frames are so compressed, there’s no tolerance for long, drawn out construction processes, and suddenly existing buildings become a major factor in the company’s search for a community for their expansion.

Here’s where that “good problem to have” comes in. Fortunately and unfortunately for Springfield, we don’t have enough vacant buildings with the right parameters to meet an industrial employers’ needs. A typical modern manufacturing building has to have at least 100,000 square feet with at least 28 foot high ceilings. Springfield’s vacancy rate for this type of building is right at 3.8 percent, and that number will continue to trend downward as the Solo building fills up and more and more spaces are taken up by growing companies. The national average is 7.1 percent, which tells you that Springfield isn’t going to be able to compete with other communities that have the right kind of buildings.

So what are we doing to remedy this?

Our team has explored a variety of options, but the optimal solution must be driven by the private sector. Local commercial broker Tom Rankin, through his development company, recently took the risk and put up a 64,000 square foot building. Before the building had been on the market two months, it was under contract and has now sold. We are certainly celebrating this as further confirmation that the market we’ve been talking about exists, and Tom and his team have already begun work on a second 80,000 square foot building. But, our experience is that this is still not enough to meet demand. We need more private sector investors to step up. And, the problem isn’t just with buildings.

If a company’s needs are so specific that they can’t find the right building, then they might consider building a new building, but only if they can start immediately. The term “shovel-ready” is being used more and more in the industry, and it means just that—companies want to start turning dirt as soon as they can. They will go elsewhere before they wait around for government approvals, for infrastructure to be laid, or for land to be assembled from multiple owners. While our region has lots of well-situated land assets, few have the infrastructure and approvals necessary to move quickly if an employer is ready to begin construction.

This is where collaboration is going to be key—not just within Springfield, but throughout our entire region. But, before anyone can benefit we have to make room for growth.